Forex analytics have key importance and is an essential part of trading in the international market. With the aid of special instruments, which are called charts and trading bar graphs, a trader can forecast the market changes. To read these charts it is essential to know what types of graphs exist and where they can be used.

The types of most popular graphs

Содержание статьи:

Linear

- It is one of the easiest charts in the forex market.

- Practically all indicators forex have linear charts function.

- It is reflected as a line that most of the time is built according to “close” prices.

- When consulting such a graph, a trader can analyze any information concerning the price.

- No superfluous information interferes the analysis.

- Linear charts assist to find and test different graphical patterns.

- As far as disadvantages are concerned, it is quite difficult (and sometimes just impossible) to get information about what was happening in a certain period of time.

- It does not depict various gaps in prices.

Bar charts

- Bar is a vertical line with horizontal marks on it.

- Both an indicator and a forex forecaster have this type of charts in their systems.

- A mark on the right side means an “open” price, on the left – a “close” one.

- Bar charts have so-called shadows. They appear when minimums and maximums do not coincide with open and close prices.

- Bars are very informative in comparison with linear type of charts.

- They have all details of one particular deal in a certain length of time.

- For example, bars of time show the price of opening and close hours, trading range during this hour, and extremums (maximums and minimums).

- A disadvantage is in a difficulty to see all changes in a period, though it is quite enough to look at the previous timeframe and everything becomes clear.

A profitable forex strategy consists of many components, but if a trader cannot analyze and take the needed information out of these components, any strategy may easily become unprofitable.

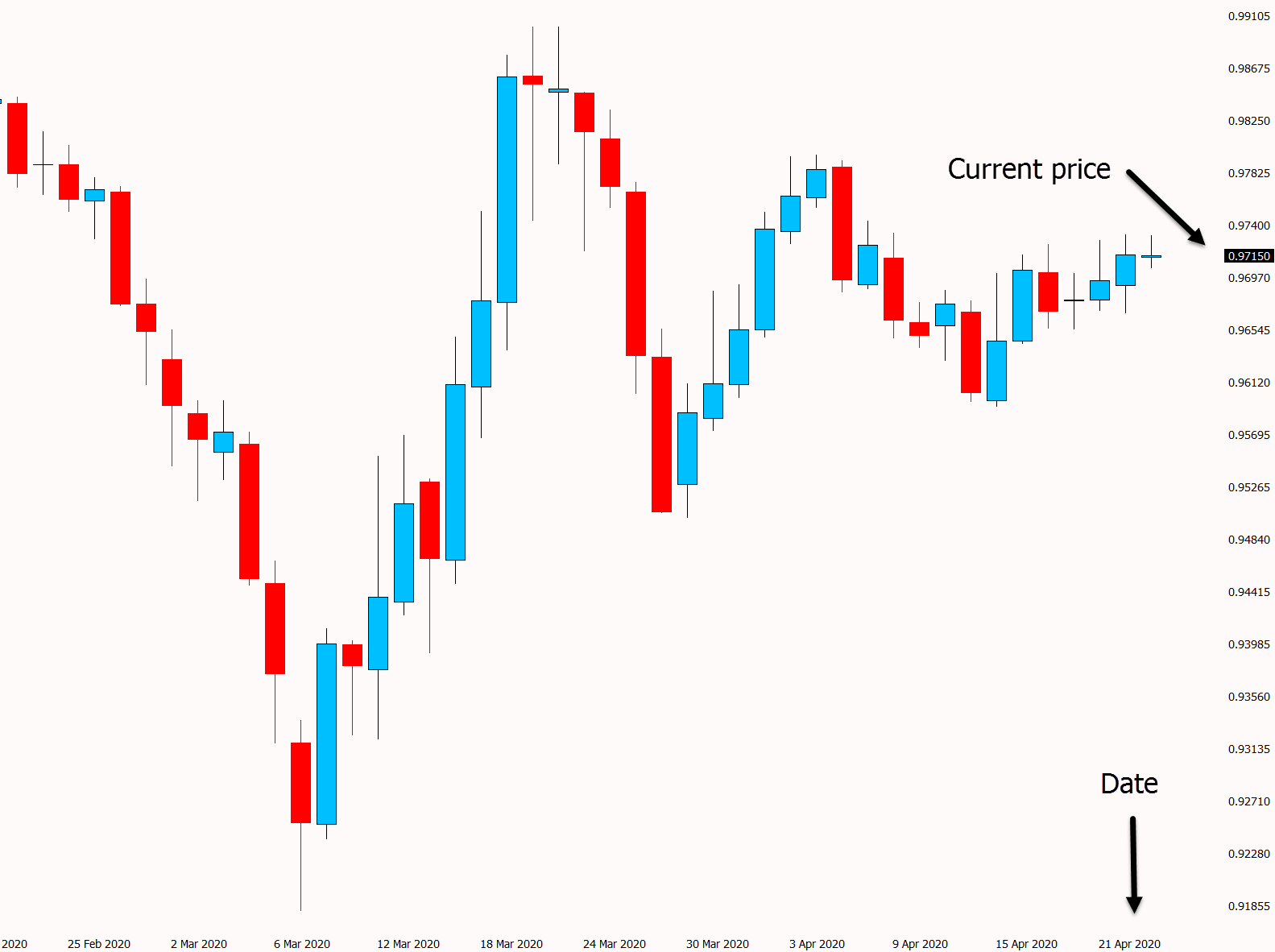

How to read Japanese candlesticks

Every chart has its own peculiarities and it is wrong to say that all graphs can be read the same. As an example of a chart Japanese candlesticks are of significant interest, because they are pretty popular among the traders in the market.

A famous rice trader in Japan created this chart in the 18-th century. For many years long people have no idea about this chart. However, thanks to Steve Nison the world have known what Japanese candlesticks are.

A candlestick has:

- a body (that may be variously colored or hollow)

- and shadows (appear if the extremums do not coincide with “open” and “close” prices.

The chart represents a valid analytical system that can be used without additional instruments (though it is recommended to use the levels of support and resistance).

To read the candlestick chart:

- a trader should choose a color of the body, for example, black is for bearish and white is for bullish.

- An open price in the bearish candlestick is higher than a close price. It is otherwise in the bullish candlestick: the open price is lower than the close price.

- As far as shadows are concerned, they show maximums and minimums for the period defined by a candlestick. In case a candlestick has no shadows, it means that the open and close prices do not coincide with extremums.

- If a candlestick does not have a body, the open price coincides with the close one.