Financial economists like to believe investors make investment decisions based on the principles of rationality and optimising returns. However, in the real world, this simply isn’t true. The reality is that financial decisions are often influenced by several factors, including emotions and behavioural biases. In recent decades, behavioural psychology, economics, and finance has come together in a surge of contemporary research, opening numerous clues into the emotional aspects of investing, outside of the classical framework.

Where Psychology Meets Economics

Behavioural finance focuses on the psychological factors that influence investors’ decisions in the financial markets, based on how information is interpreted and acted upon. Researchers have discovered that individuals use many mental shortcuts when making complex decisions. And these heuristics can sometimes bias their judgments, leading them to faulter when it comes to financial trading.

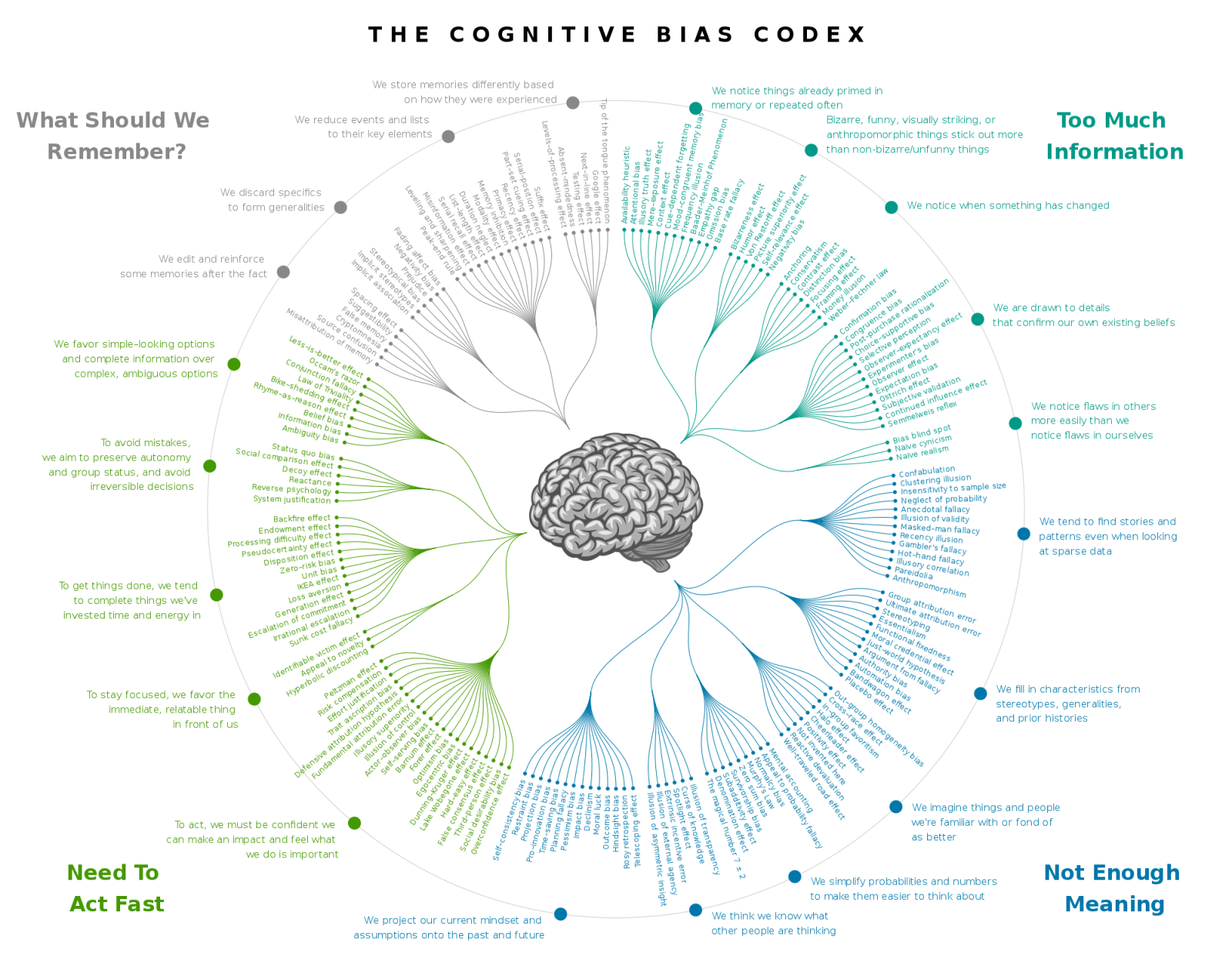

Behavioural biases are unconscious and often irrational beliefs that influence peoples’ decisions. Many of these biases can heavily affect investment behaviours.

Here are some of the most common behavioural biases to watch out for when investing, and how you can avoid them.

Loss Aversion

Loss aversion refers to the bias of avoiding losses whilst over seeking gains. For example, a 2019 study from the Journal ‘Scientific Reports’, found people are comparatively more sensitive to losses than they are to gains in decision making. Loss aversion helps us understand why losses hurt more than gains are appreciated. Finance professor at Creighton University, Robert Johnson, also argues that loss aversion can cost people a lot of money in the long term.

“The biggest financial mistake people make is taking too little risk, not too much risk,” he says.

Loss aversion can cause individuals to side-step small investment risks even when those risks are probably justified. It explains why people would rather save than invest, even knowing that inflation will eventually erode its value. Meanwhile, most investments when held for long enough, will eventually pay off.

How to avoid it: Emotion needs to stay out of the equation. Consider an investment strategy that adopts small but manageable risk. For example, start by considering assets that typically perform well over the long term, such as an index fund that tracks the S&P 500.

Anchoring bias

Anchoring bias occurs when an individual overvalues an initial piece of information to make subsequent judgments. When investing, this can influence decision-making regarding a security, such as when to sell or buy. Most investment decisions are vulnerable to anchoring bias, due to the multiple, complex judgements that are involved. For example, an investor may hold a stock longer than they should, only because they’ve “anchored” on the higher price than they purchased it at. Here, the buying price biases their judgments about the security’s actual value.

How to avoid it: Anchoring can be evaded with thorough research and a well-thought-out decision process. A comprehensive assessment of a security’s price helps reduce this cognitive fallacy. Finally, accept new information that can inform your trading, even if it doesn’t align with what you initially learned.

Herding Bias

Herding occurs when investors follow the crowd, rather than forming their own decisions based on financial data. For example, masses of traders might copy the investments of a well-known hedge fund, simply based on the assumption that they must know what they’re doing. Investors also follow the herd as it feels safer, or due to the ‘fear of missing out’.

Herding can be a dangerous game. Historically, this bias has contributed to financial bubbles like the dot-com bubble and even the real estate meltdown of the mid-2000s, the aftermath of which brought about a global economic recession.

How to avoid it: Take a step back and look at investments carefully. Be sure to understanding what you’re investing in. Traders should make use of a company’s fundamentals to judge its attractiveness as an investment. At the same time, try to avoid trading primarily based on the trending behaviours of the wider market.

Trading psychology is an important discipline to understand by anyone that aims for long-term success in the financial markets. With fear and greed often overclouding an investors rationale, emotional control is key to achieving consistency when trading.

Being aware of these biases is the first step to avoiding them and should help guide investors to making wiser investment decisions. Just as business magnate and investor, Warren Buffet, wrote. “The most important quality for an investor is temperament, not intellect.”