Correlation on the stock exchange, what is it and how can you establish the relationship of exchange rates

According to Wikipedia, the correlation is the relationship of two or more quantities, and the main measure of this relationship is the correlation coefficient.

This concept can be found in almost every area of economic activity, including finance.

If we talk about what constitutes a correlation on the exchange, then we can say that in this case the relationship of exchange rates is considered.

That is, how interconnected are changes in the price of one asset with other assets listed on the exchange.

This phenomenon can be most clearly explained using a specific example, comparing how prices for precious metals gold and silver change:

The presented chart clearly shows how interconnected these two assets are, how the price of gold follows the price of silver.

Types of correlation on the stock exchange and coefficients

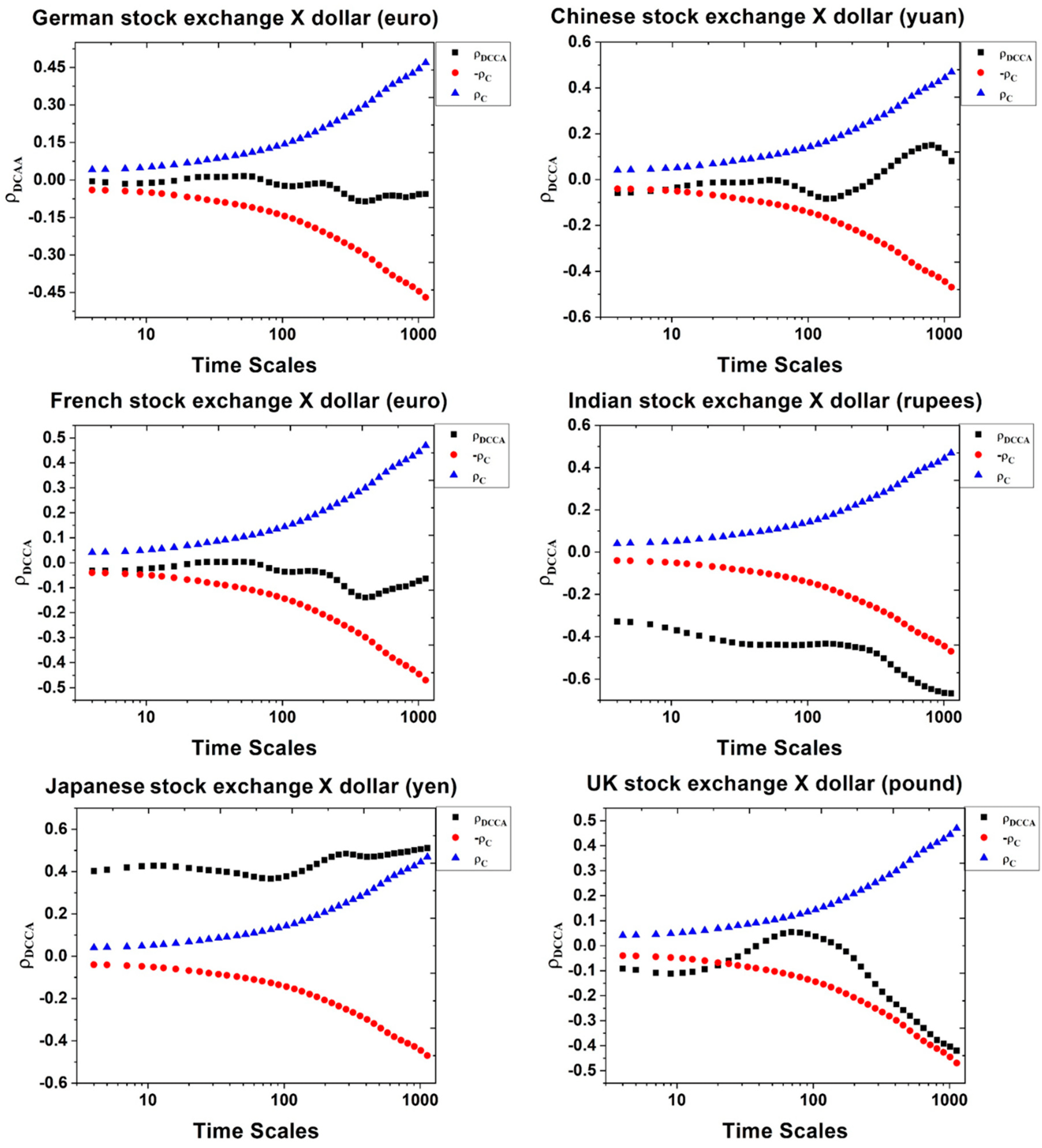

Correlation on the stock exchange can be of two types – direct and reverse, with a direct relationship, the price of the assets under study moves in one direction, while in reverse, in opposite directions.

For example, let’s take the price of gold and one of the most important stock indexes in Japan, NI225, which includes prices for 225 of the most popular stocks:

The figure clearly shows an example of what an inverse correlation is on the stock exchange, as soon as the price falls on the stock market, investors begin to actively buy gold, thereby causing its rise in price. Conversely, the growth of the NI225 index contributes to a decrease in the price of the precious metal.

At the same time, it should be noted that the existence of a direct or inverse correlation on the exchange is not at all mandatory, there are a lot of assets whose rates are completely unrelated.

The exchange correlation coefficient is an indicator characterizing the degree of interconnection of the selected assets, its values vary in the range from -1 to +1.

The closer the indicator is to one, the stronger the direct or inverse relationship of rates.

The calculation of the stock correlation coefficient is carried out using special calculators:

An example of such a tool is given on the page – http://forexluck.ru/skripty/icorrelationtablev3

Exchange correlation is very successfully used in various trading strategies, the basic principle of this trading option is to determine which of the assets the price changes first, and which only repeats the changes.

A ready-made template for such a strategy and a description of its principles can be found here – http://forexluck.ru/shablon/shab-korrelycii