Spoofing (from the English “spoof” – deception) is a tactic used in the financial markets, which aims to manipulate prices and create artificial changes in trading.

This type of manipulation strongly influences market dynamics and can create unfavorable conditions for other market participants. In this article, we will go into the details of stock spoofing and its implications.

Spoofing involves placing false orders to buy or sell assets with the intention of changing market conditions and defrauding other traders.

Such false orders are usually placed in high volume and at favorable prices to attract the attention of other market participants and create the illusion of activity.

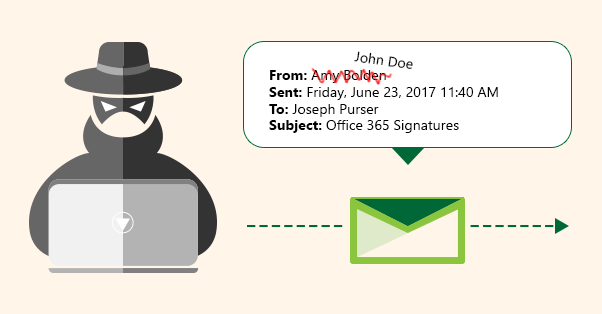

However, as soon as other traders respond to these orders and try to make a trade, the manipulator cancels their false orders, creating a false impression of supply or demand in the market:

One of the main negative consequences of exchange spoofing is the distortion of market liquidity .

When traders react to false orders, they may open or close their positions at unrealistic prices, which affects market orders and can cause significant price fluctuations. As a result, this can lead to a loss of traders’ confidence in the market and a decrease in overall liquidity.

Exchange spoofing can also be used to manipulate market data and make illegal profits. For example, a manipulator can create artificial price movements to confuse algorithmic systems and trading advisors that react to certain market conditions. This may allow the manipulator to gain advantageous positions or take advantage of information about a large volume of transactions.

Spoofing on an exchange is illegal and subject to the regulation of financial markets. In various countries, there are rules and regulations aimed at preventing and suppressing such manipulations.

For example, in the United States, stock spoofing is considered a crime and subject to criminal prosecution.

Regulators and exchange operators are actively working to detect and prevent instances of exchange spoofing. This includes the use of various technologies and algorithms aimed at detecting suspicious trading and establishing rules to prevent manipulation.

In conclusion, spoofing is a serious problem that affects market dynamics and negatively impacts traders and investors. These market manipulations more than once led to quite serious consequences, for example, they caused a crash on the NYSE stock exchange in 2010 when the Dow Jones index collapsed by 1000 points in just a few minutes.