Many traders often use intraday Forex price charts based on time frames like 5 or 60 minute periods. On such charts, a bar (OHLC bar or candlestick) is indicated at the end of each time interval. For example, on a 60-minute stock chart, a bar appears at 10:30 am, 11:30 am, 12:30 pm, and so on until the end of the trading session. The only parameter considered is time, and trading activity and volume do not matter. Therefore, using the same time frame, the number of bars in a trading day will be the same.

Interval charts allow traders to analyze price action not only on timeframes, but also on different interval data. Tick charts, volume charts, and range bars are examples of Forex charts with interval data. On such charts, a bar will be displayed at the close of a certain interval, regardless of how much time has passed.

At the same time, on tick charts, each bar reflects a certain number of trades, on volume charts it indicates the number of contracts or shares traded, and on range bar charts it shows when a price movement has occurred. in a certain amount. Let’s consider Forex interval charts in more detail.

bookmark forex charts

Содержание статьи:

An example of a tick chart is shown in the figure to the left. Such Forex charts are very convenient as they allow traders to collect information about market activity. Since the tick chart is based on a certain number of trades per 1 bar, a trader can set the time when the market is most active, or vice versa, the time when the market barely moves.

So, on a 144-tick chart, a bar will form after 144 trades (or fixed trades). Such transactions cover small orders as well as fairly large batches of orders. Regardless of transaction volume, any transaction is calculated only once. During a period of high market activity, more bars are formed, and conversely, during a period of low market activity, fewer bars are formed. Therefore, Forex tick charts are a very convenient tool for determining market volatility.

Forex tick charts differ from intraday charts based on predetermined time intervals (eg 5, 30 or 60 minutes) in that they can be based on an arbitrary number of trades. Tick chart intervals are often taken from Fibonacci number sequences, so the most popular intervals are the 144-tick intervals, as well as the 233-tick and 610-tick intervals.

Forex Volume Charts

The figure on the left shows an example of a volume diagram. Such Forex charts are based solely on the volumes traded (number of lots, shares or contracts). These bars provide a better understanding of market action as they reflect the actual volumes traded in the market. Similar to tick charts, a trader can gain insight into the speed of market movement by looking at the number and rate of formation of new bars.

In particular, on a Forex chart with a volume of 1,000, regardless of the size of the trade, the bar will form after a trade of 1,000 shares (lots). In other words, a bar can cover several small trades or one major trade. In any case, a new bar will start to form only after going through the volume of 1000 shares.

It should be noted that the volume intervals are selected individually for each instrument and the analyzed market. Volume ranges for the stock market are determined in shares, for futures markets – in contracts, and for the Forex market – in lots. Volume ranges can be adjusted for an individual trading instrument, ie an instrument that trades higher volumes and requires a larger range to provide proper chart analysis. For volume charts, the standard intervals are the following values: 500, 1000, 2000, and additionally higher order Fibonacci intervals: 987, 1597, 2584, etc.

Range Bar Chart

The figure to the left shows a range bar chart. These forex charts are based on price changes and provide an opportunity to analyze market volatility. Therefore, a bar chart with a range of 10 ticks will form a new bar every time the price moves 10 ticks (this is true for markets where prices are measured in ticks).

For example, a new bar opens at 5850. Therefore, when applying a bar with a range of 10 ticks, this bar will be active until the price touches 5860 (i.e. 10 ticks up) or 5840 (respectively 10 ticks). tick down). When there are ten ticks of price movement, this bar will close and a new one will open. By default, a bar is closed at the low or high point of the bar as soon as a certain price movement is reached.

The advantage of using range bar charts is that fewer bars form during a consolidation period, which eliminates some of the market noise found with other chart types. Since fewer bars can provide the same price action information, traders can set entry points more accurately.

Range Selection

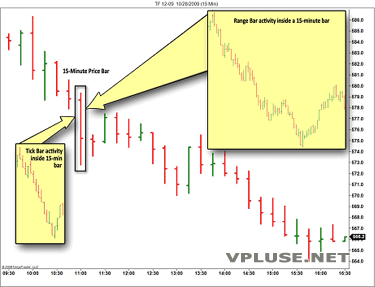

As a general rule, when a trader decides to use any Forex interval chart in his trading, the problem of choosing an interval arises. The correct choice of intervals depends entirely on the chosen trading style. If a trader is looking to cover large moves and plans to stay in the market as long as possible, then in this case it is advisable to choose a large data interval. If a trader prefers to trade with minimal moves and get out quickly, then it is better to choose the smaller intervals. When choosing intervals, there is no universal approach, it all depends on your trading style and personal preferences.The figure on the left shows a comparison between price, tick and range bar charts.

As a general rule, when a trader decides to use any Forex interval chart in his trading, the problem of choosing an interval arises. The correct choice of intervals depends entirely on the chosen trading style. If a trader is looking to cover large moves and plans to stay in the market as long as possible, then in this case it is advisable to choose a large data interval. If a trader prefers to trade with minimal moves and get out quickly, then it is better to choose the smaller intervals. When choosing intervals, there is no universal approach, it all depends on your trading style and personal preferences.The figure on the left shows a comparison between price, tick and range bar charts.

conclusion

Various types of interval charts allow market participants to consider Forex price charts as charts formed not only based on time, but also on other factors. Market activity is also easier to assess based on the bars formed. Just like any other analysis tool, these charts should be tailored to your personal trading style. To do this, traders need to experiment with different types of intervals and data to find the combinations that best suit the trading method.All of these types of charts provide a truly unique opportunity to assess market movements, which cannot be achieved using time-based Forex charting methods.