Active trading can be stressful, time-consuming, and not yield the desired results. On the other hand, there are alternatives. You can look for an approach to investing that is less burdensome to your resources and requires less time, as many other investors do. Or just a more passive method of investing. But what if you want to invest in the markets but aren’t quite sure how to get started? More specifically, what would be the best strategy to create a position that you can hold for a long period of time? In this article, we will look at an investing method known as dollar-cost averaging, which helps reduce the impact of certain risks associated with getting into a position.

What Is Dollar-Cost Averaging (DCA)?

Содержание статьи:

- 1 What Is Dollar-Cost Averaging (DCA)?

- 2 Why Use Dollar-Cost Averaging?

- 3 Example Of Applying Dollar-Cost Averaging Approach

- 4 Who Should Use Dollar-Cost Averaging?

- 5 Is DCA Suitable For Crypto Investing?

- 6 How To Use DCA As A Bitcoin Investment Strategy

- 7 Advantages Of Dollar-Cost Averaging

- 8 Disadvantages Of Dollar-Cost Averaging

- 9 How To Apply DCA Strategy?

- 10 Conclusion

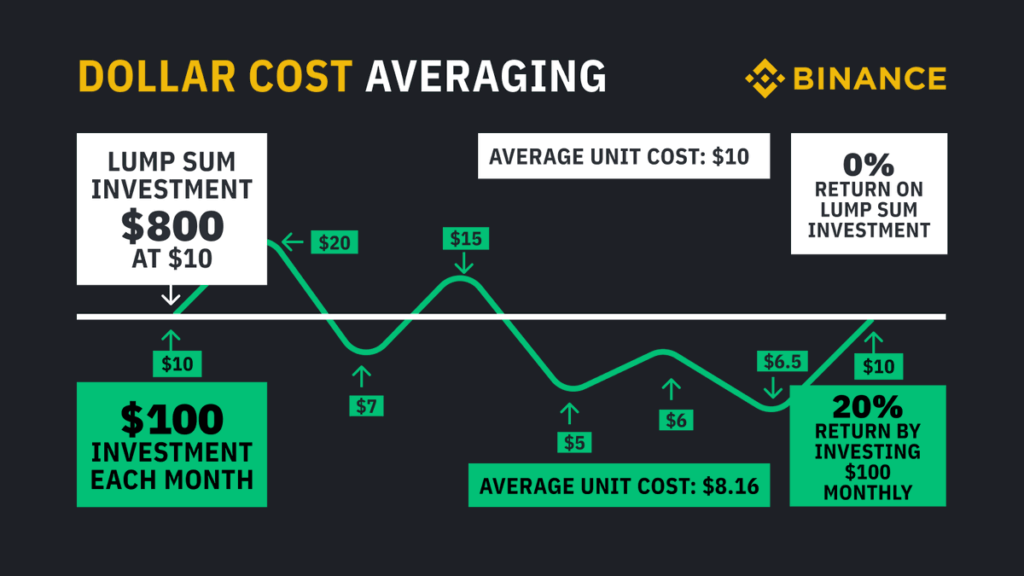

Dollar-cost averaging (DCA) is a less weighted investment plan that helps investors get rid of the influence of emotional factors when making decisions. Here, the investor seeks to mitigate the effects of price volatility by spreading purchases over predetermined intervals. Instead of investing a lump sum in an asset class, the investor prefers to invest a fixed amount weekly, monthly, or bi-monthly. This is done regardless of price changes.

Think of dollar-cost averaging as an effective way to navigate a volatile market without having to determine the best entry point. Because capital is spread out over predetermined intervals, the strategy tends to smooth out the purchase price over the life of the investment. This is much better than investing a large amount at the peak of the price all at once.

We can say that dollar-cost averaging is a suitable investment strategy for beginning investors or individuals who don’t want to burden themselves with the technical aspects of market analysis.

Why Use Dollar-Cost Averaging?

The main benefit of using dollar-cost averaging is that it reduces the likelihood of placing an order at the wrong time. When it comes to trading or investing, one of the biggest challenges is accurately timing the market. Even if the trading idea is moving in the right direction, there is a chance that the timing of the trade may not work out as planned, causing it to be unsuccessful. A dollar-cost averaging strategy can help reduce the impact of this risk.

If you invest the same total amount of money in not one huge chunk, but many smaller ones, you will almost certainly get a higher return than you would otherwise. It’s surprisingly easy to purchase at the wrong time, and it can lead to consequences that are not the most desirable. You also have the opportunity to remove some biases from your decision-making process. When you decide to use dollar-cost averaging as your investment plan, the strategy will make all the decisions for you.

Of course, this strategy does not completely eliminate all risks. The only purpose of this plan is to streamline the market entry process to reduce the likelihood of bad timing. This strategy is not a reliable method of investing effectively; in addition to its use, there are many other aspects to consider.

As we’ve already pointed out, timing the market correctly is very difficult. Even the most experienced traders sometimes have difficulty reading the market effectively. As a result, if you use dollar-cost averaging to enter a position, you may also need to think about how you will exit the position. That is, about the method of exiting a position that can be used in the trading market. Now, if you have already decided on the desired price (or range of acceptable prices), this step should be fairly straightforward. You again divide your investment into equal portions, and as the market approaches the target, you begin to sell those portions. In this way, you reduce the likelihood of missing an opportunity to exit at the right moment. However, it depends entirely on the trading system you use.

Some people adhere to the “buy and hold” investment philosophy, which states that the ultimate goal is to never sell the assets you purchase because it is assumed that their value will rise over time.

The Dow Jones Industrial Average has been on an upward trajectory for quite some time, despite occasional drops into negative territory. The goal of a “buy and hold” investment strategy is to create a position in the market and hold it for a sufficient amount of time to ensure that market timing is irrelevant. However, it is important to remember that this particular technique is often designed for the stock market, and it may well not apply to the cryptocurrency and forex markets. Remember that the success of the Dow is inextricably linked to the real-world economy. The performance of other asset types will be somewhat different.

Example Of Applying Dollar-Cost Averaging Approach

Let’s look at this strategy with an example to better understand it. Consider the following scenario: we have a set budget of $10,000, and we think it would be prudent to invest in bitcoin. We believe that the price is likely to fluctuate in the current zone, and we think this is a great place to buy and build a position using the DCA technique. We can divide $10,000 into one hundred equal halves, each worth $100. No matter what the price is, we will buy it at $100 each day. By doing so, we will be able to spread our entry over three months. Now let’s change things up a bit and use a new strategy to illustrate how adaptive dollar-cost averaging can be. Let’s imagine that the price has recently fallen to a bear market, and we don’t expect a sustained uptrend in the other direction for at least another two years. Nevertheless, we expect a bull market at some point in the future, and we would like to be ready for it now.

Should we continue to use the same tactics? Almost certainly not. The time horizon for this investment portfolio is much broader. We have to be prepared for the fact that this plan will still need a budget of $10,000 a year for the foreseeable future. So, what actions do we take? Again, the investment can be broken into 100 equal halves, each worth $100. On the other hand, this time we are going to buy $100 worth of bitcoin each week. Since there are about fifty-two weeks in a year, the whole approach will be realized in just under two years.

By acting this way, we will be able to create a long-term position even if the downtrend continues. We will not miss the train when it starts moving up, and we will minimize some of the dangers associated with buying during a downtrend. Keep in mind, however, that this tactic can be dangerous because we will be buying during a downtrend in the market. If you are an investor, it is in your best interest to refrain from buying until the uptrend strengthens before making any moves. If you wait, the average value (or stock price) will likely increase, but in return, much of the risk will be mitigated, which could lead to losses.

Who Should Use Dollar-Cost Averaging?

First and foremost, it is ideal for long-term investors. The goal is to stick to an investment cycle in which a fixed amount is consistently invested in an asset. There is no room for doubt, greed, or fear in short-term investment strategies. It is also worth noting that dollar-cost averaging is more effective in a bear market. While most investors are wary of buying, constantly wondering if they’re getting in too early or too late, your averaging plan will serve as a solid base for buying during a downturn.

Is DCA Suitable For Crypto Investing?

The dollar-cost averaging strategy is suitable for any volatile investment class. However, DCA for cryptocurrencies may be even more important. This is because cryptocurrency is second to none when it comes to volatility and the inability to predict price movements. So you might also benefit from an averaging strategy. It will help level out your buy prices and take advantage of market downturns.

However, it is very important to avoid taking large losses during a bull cycle. Note that the DCA investment strategy is more effective when digital asset prices are falling. This is because the average bitcoin purchase price decreases with each subsequent purchase.

How To Use DCA As A Bitcoin Investment Strategy

To use cost averaging as your own strategy for investing in bitcoin and other cryptocurrencies, simply set up a recurring purchase function on your preferred cryptocurrency exchange. Most leading exchanges have this feature. You set the frequency of purchases (daily, weekly, monthly) and the amount, the exchange does the rest for you. Please note that in the USA this function is not available on every exchange due to regulatory nuances.

Alternatively, if the regular purchase feature is not available, you can perform the same manually by choosing a fixed amount and making purchases at selected intervals. However, this will require more discipline and effort on your part, as opposed to the “set it once and forget it” method described above.

Advantages Of Dollar-Cost Averaging

If one invests a portion of their income regularly, they have few alternatives to DCA. But one can experiment with the frequency of deposits, rebalancing, and some other parameters. In any case, the averaging strategy has advantages.

Emotions

An investor’s emotional well-being is no less important than the financial performance of the portfolio. And this strategy is quite safe and psychologically comfortable for beginners: it disciplines and protects the investor from unsuccessful entry and related negative emotions. Investing small amounts regularly, regardless of market conditions, is not as stressful as trying to guess the best entry point. Even if the entry point is good, the investor will still get upset if the next day the asset falls in price. Of course, if you look at it all from the perspective of a long-term investor, what is happening is just market noise. But volatility can be nerve-wracking, even when objectively all is well.

The strategy protects against the risk of making ineffective decisions due to greed or fear. For example, beginners often buy more when the stock price has already risen. And when quotes fall, they sell the asset even though it may be a good opportunity to buy it.

With dollar-cost averaging, all of this is gone: you focus on buying assets for a certain amount in a set period, ignoring market fluctuations. This is especially true when it comes to volatile assets like stocks and during periods of volatility when markets are stormy.

Simplicity

The DCA strategy is great for passive investors because it requires minimal involvement and time commitment. An investor doesn’t have to monitor the market or perform fundamental or technical analysis. It is enough to determine the desired composition of the portfolio, regularly replenish it and purchase the previously selected assets. This strategy is often used in the case of lazy portfolios, which consist of ETF funds.

Benefit when the market falls. The DCA strategy is used in bear markets to gradually accumulate positions. After all, if one waits until the bottom, an investor may miss the moment when the market rebounds quickly, or, conversely, buy assets with all the money too early.

Ultimately, an investor needs to find a balance between portfolio returns and risk tolerance. If an investor is not ready to constantly monitor the market and emotional peace of mind is important, then dollar-cost averaging is the right way to invest.

Disadvantages Of Dollar-Cost Averaging

Although dollar-cost averaging can be a successful method, some do not believe in its effectiveness. Undoubtedly, it achieves the best results when there are significant fluctuations in the markets. This makes sense, given that the purpose of the strategy is to reduce the impact of excessive volatility on a position.

On the other hand, some people believe that it will cause investors to miss out on potential profits while the market is doing well. How so? The assumption that those who invest early will benefit more can be made if the market continues to be in a bullish trend for an extended period of time. Using dollar-cost averaging in this way can have the effect of reducing the gains made while ahead. In this particular scenario, investing one large investment may produce better results than dollar-cost averaging.

At the same time, the obvious disadvantage is the increased cost of transaction fees. Given that this strategy involves multiple purchases, the cost of trading can go up a lot. However, depending on your profitability and investment horizon, you may not feel the effect of the additional overhead incurred with recurring purchases compared to a one-time purchase. Regardless, most investors do not have a significant amount to invest at once. However, they may be able to invest small amounts over a long period of time, in which case dollar-cost averaging may still be an appropriate method.

How To Apply DCA Strategy?

There are two variants of how investors can use the dollar-cost averaging system. Let`s have a look at them.

Option 1: Investing a Large Amount in Portions

If you have a large sum of money in your hands – for example, from the sale of real estate or a car – and you want to invest it in the stock market, a dilemma arises. You can invest all at once – it is called lump-sum investing, or LSI. Or you can invest money in small portions, i.e. according to the dollar-cost averaging strategy.

Suppose an investor has $8000. He can invest all at once or invest $1,000 in the same assets over eight months. During this time, due to market volatility, the price of assets will rise and fall. The price range, let’s say, is from $7.5 to $14 per share.

In the first case, if an investor invests the whole amount at once, depending on current market conditions, he can buy the stock either cheap or expensive. And this uncertainty causes additional stress, especially if the asset falls in price after the purchase. If the investor uses an averaging strategy, however, he will gain a position at an average price of $9.61.

Option 2: Regularly Investing a Portion of Income

The DCA strategy is ideal for investing relatively small amounts regularly. For example, if you invest a portion of your salary in the stock market, you can buy the same assets once a month. You can add to the portfolio not every month, but every two or three months, or even less frequently. Or another option: temporarily park available funds in some secure instruments and buy assets according to the chosen strategy only at the next rebalancing, for example, once every six months. It depends on financial possibilities and personal preferences.

In any case, under this approach, the investor regularly averages the price of purchased assets. In this case, they buy assets as soon as or nearly as they have enough money for that. In other words, it is a certain combination of “regularly invest” and “invest all at once” strategies.

If you invest the money as soon as you have it, you will get higher returns on average. Over the long term, markets tend to grow, and their returns are usually higher than the same deposits, although there are no guarantees.

Conclusion

Dollar-cost averaging is a powerful investment strategy for novice and less technically savvy investors, especially for long-term investing in a volatile market. As we3 have mentioned above, it has a low probability of mispricing the market, and the risks resulting from making investment decisions based on emotion are reduced.

However, it may cause some investors to miss out on profits made during bull markets, according to some who are skeptical of this strategy. Nevertheless, lost profits are not the end of the world, and DCA is still a viable approach to investing for many people.